She Lost 15 Lakhs in this Crypto Scam

Stay safe during this upcoming Bitcoin bull-run

I am writing this post to spread awareness about the scams circulating around the web. I am a Bitcoin advocate but that doesn’t mean someone falls for a fraud related to crypto because of ignorance.

In this post, let’s understand the difference between Bitcoin and Crypto and become aware of the scams out there.

There is going to be a huge Bitcoin bull run coming in 2024 and 2025 and many people will likely fall victim to shady businesses who claim big returns.

I recently met a 60-year-old woman who lost 15 lakhs in a scam. I want to share about it so that you don’t fall for such a scam and then blame Bitcoin in general.

This is how it went:

She clicked on an ad online that promised something related to crypto and making returns. Some of these scams also circulate in the name of “forex trading”.

Sometimes these ads will contain a reputed brand name such as Narayana Murthy, Ratan Tata, etc. They did not endorse these brands. They are probably using images from Google.

She made an account on a fake website. An “account manager” called her and stayed in touch via telegram. The goal of this account manager is to push unaware customers to part with their money. Nothing else.

The guy promised her that she could 4x her money in 2 months through “crypto trading”. There is no real trading happening here.

They guided her to buy USDT (a US-dollar stable coin on crypto rails) on Binance via the P2P trading method. This was the on-ramp. Because if you transfer money to a real person’s bank account, that bank account could get frozen.

You are just buying USDT via P2P from real sellers and once the money is in USDT, the transfers can be done on the blockchain and the destination account can be any wallet that doesn’t have any KYC. So it is difficult to trace who received the money.

She transferred the initial $3000 worth of USDT to the scam website’s address.

The trading portal claimed that they had invested in it and kept showing “growth”. There was no real money there.

They charged her another 12 lakhs (around $13,500) in the name of “trading fees”. She sent it with the expectation of returns, but all this money was a one-way transaction.

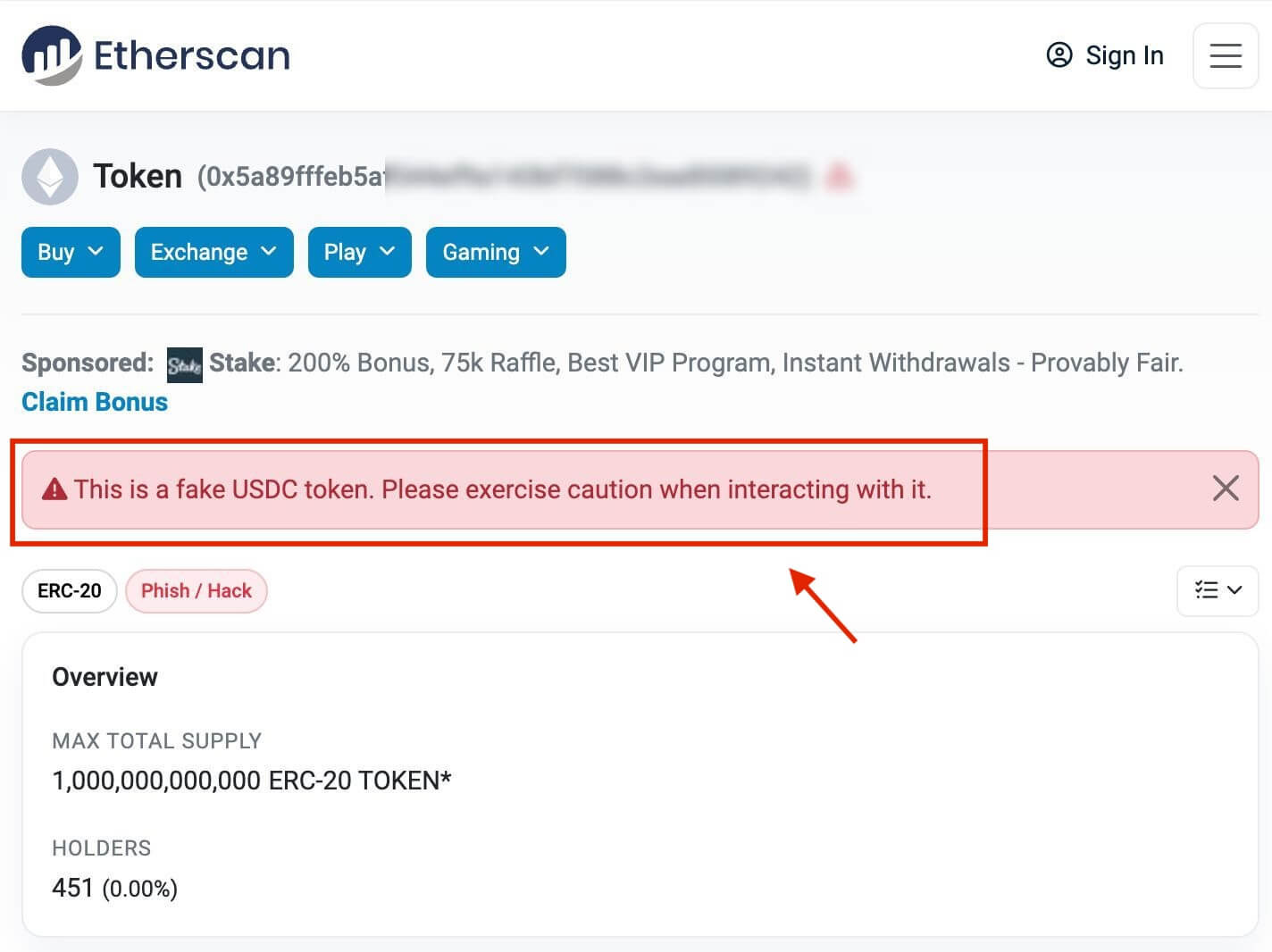

They asked her to make a Coin Base Wallet and transferred $44,000 USDC fake tokens. This is not a Coin Base exchange account.

Her Coin Base Wallet showed a token with $44,000 in balance, but it was a fake USDC token. (USDC is another stable coin like USDT where one coin is worth $1 US Dollar).

They arranged a call from “Coin Base Headquarters” which was a fake call. She thought she actually had $44,000 in her wallet.

They were asking her to send another 3 ETH to withdraw the money to her bank account. This was the last part of the scam where they wanted to take out even more money from her.

She smelled something fishy and contacted someone who connected her to me. I checked her wallet balance on Etherscan, an Ethereum blockchain explorer and it clearly said that it’s a fake token.

The scammers went to huge lengths to make sure that their entire operation looked authentic.

She has put 5 lakhs of her own savings. 5 Lakhs of her husband’s savings. And another 5 lakhs borrowed from someone. I felt bad to be the bearer of the bad news and she was almost in tears. I didn’t know what the next step from here would be.

Even if she files a complaint, I don’t think anything can be tracked. The scammers are mostly operating from Dubai or some other country.

If she had invested this just in Bitcoin and held Bitcoin in self-custody, it would’ve appreciated by 200% from the time she started investing. You need to have a deep understanding of Bitcoin and spend a lot of time learning about it.

Points to Keep in Mind to Stay Safe

If you want to invest in Bitcoin and protect your wealth, here are the things you should keep in mind.

Do not trust anyone on the web. We live in a world where even relatives cheat us of our money, so do not trust anyone on the web. The more friendly the sound, the higher the chances that they are trying to scam you.

I have come to the conclusion that everything else apart from pure Bitcoin is a scam. Yes, even ETH and Sol. Some people might get triggered because I say this but I ask them to do their own research.

All the meme coins like Dogecoin and real-world-looking projects are unregistered securities which the SEC (US Securities Exchange Commission) doesn’t approve of. Bitcoin is the only truly scarce digital commodity.

If you cannot handle the volatility of Bitcoin, do not buy Bitcoin. If you don’t like the heat do not enter the kitchen.

You have to understand how cryptographic wallets work, how the blockchain works, and how Bitcoin is decentralized and regulated by the rules of the network. If you are buying Bitcoin, put some money and don’t think about the price for at least 5 years. The only people who lose money by buying Bitcoin are the ones who buy it at the market peak and panic sell at the bottom.

Do not touch USDT, USDC, P2P trading, trading bots, or altcoins. Only buy Bitcoin from regulated and approved exchanges. In India, Mudrex, CoinDCX, and WazirX are some of the regulated exchanges.

You need to set up a hardware wallet (like Trezor, Ledger, Keystone, etc) and withdraw the coins to your own wallet. You cannot keep the money on the exchange because how can you trust that exchange? People who invested money in Vauld and BitBns have got their funds frozen, locked, and unable to withdraw Bitcoins or INR. Exchanges like FTX collapsed and a lot of people lost money.

You can set up your own 256-bit secured wallet on an open-source wallet like Sparrow Wallet. If you are downloading this, make sure you are downloading the original one. There was a way to verify the signature of the creator of this software using GPG. I cannot explain everything here, but use it as pointers to do further research. There are plenty of tutorials on YouTube for this.

The exchange has to send your Bitcoins to this wallet. This balance can be checked on the blockchain. One of the blockchain explorers is Mempool.space.

Unless you can see your balance on a mempool URL, it’s not your Bitcoin.

Here’s an example of the world’s largest Bitcoin balance address. It has 248,597.49 Bitcoins worth $15B dollars.

Even if you have 0.0001 Bitcoin, it will show here as a confirmed balance. This is called a UTXO (Unspent Transaction Output).

There are many Bitcoin blockchain explorers on the web and you can also download your own copy of the blockchain (around 750GB) into a local private server. You will be able to check your balance on your own server instead of a public server. This takes time and practice to understand.

If you have an exchange account, and the account balance shows something, you are trusting the exchange that they have that real Bitcoin. But Bitcoin is a trustless system based on mathematics, science, and cryptography. Only if the Bitcoin is on the blockchain that you have the private keys to, it’s yours. Else it’s not yours.

Bitcoin is a self-custody asset. Like having a gold coin in your pocket. Except it’s digital and it is decentralized.

A lot of people think that Bitcoin is an unregulated asset. But it is regulated.

The supply of gold is regulated by nature

The stock market is regulated by a bunch of humans in a committee who report to the government.

Bitcoin is regulated through network rules and decentralization that everyone in the network agrees on. It’s like Chess rules. There is no central authority.

If you do not have the patience to understand all this deeply by doing your own research, do not invest in Bitcoin. It is a great opportunity but it only comes to the people who have put in the time and effort to understand it deeply.

Stay safe out there.

Cheers,

Deepak Kanakaraju

P.S. The chances that even Bitcoin can go to zero are not zero. Bitcoin is safe only as long as it stays decentralized and secure. If Bitcoin’s security is broken with quantum computers, then Bitcoin will not be a safe store of value. Understand your risks by doing your own research.

Hi Deepak. Thank you for this post

I would like to know how you buy bitcoins and transfer it cold wallets because as far as now currently indian exchages do not allow to withdraw.

Whereas foreign exchanges are concerned they are not compliant in India.