I Am Worried: Risky Debt-to-GDP Ratio and Inflation

Your life is impacted by your country's debt. Learn macroeconomics.

I don’t post much about economics but I study it a lot. I believe startup founders and digital marketers should study macroeconomics and understand how major indicators such as debt-to-GDP affect our lives.

Total Government Debt: This includes the sum of all the debts a government owes, including domestic and foreign debts.

Gross Domestic Product (GDP): This is the total market value of all goods and services produced by a country in a year.

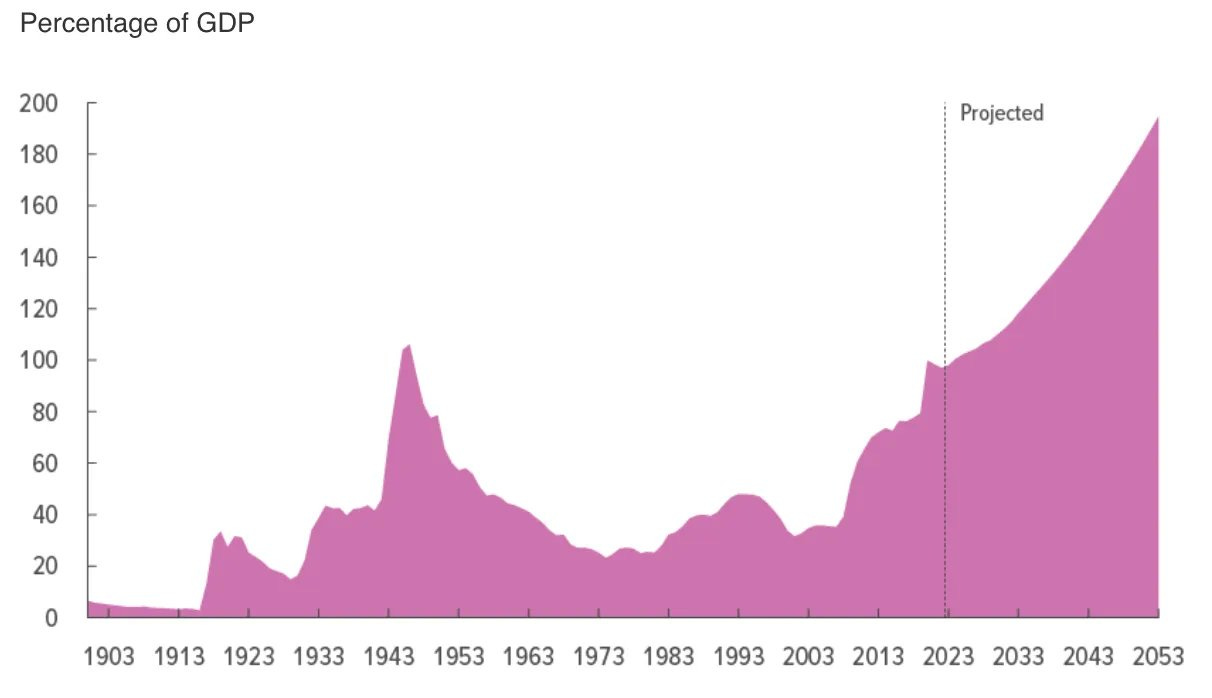

In general, it is not healthy for a country to have a debt-to-GDP ratio of more than 120%. The US public debt reached an all-time high of 132% in 2020. Now it has come back down to 121%, but it is still dangerous and risky.

When the GDP is high and public debt is low, the economy is healthy because the central banks can keep the interest rates high and it keeps inflation in check. The interest rates are high, and the cost of debt repayment for government debt is also high but it can be managed because the GDP is high.

When the GDP is low compared to the public debt, the interest rates cannot be kept high for a long time because high-interest rates discourage retail and institutions from taking on debt but also limit the capability of the government to increase further debt. The government cannot take on debt to repay its debt easily.

When the interest rates are high, the cost of debt repayment also is high for the government and hence the government has to charge more taxes from its citizens. But taxes cannot be raised beyond a certain point, because unrealistic taxes make people angry with the government. It’s already happening in Canada.

The government has a tool to reduce the debt-to-GDP ratio. They reduce the interest rates. When the cost of debt becomes cheaper, the government can raise more debt to repay the previous debt. The government raises more debt by issuing bonds. Bonds with a % yield (like 5-8%) are bought by corporations, foreign nations, and retail HNIs.

At some point, the demand for bonds will diminish and if it goes to zero, the government still can raise debt by forcing the central bank to buy the bonds, and in return, they get cash for the asset (the bond) which is just a promise to repay the loan. It’s like an unsecured loan that we might get from a bank without collateral.

However, reducing interest rates also creates inflation. Because money is created through debt. When consumers, corporations, and the government go into debt, it creates more money in the system which is reflected in assets going up first (gold, Bitcoin, real estate, stocks) followed by the rise in prices of everyday goods that are needed for daily living.

When inflation happens, debt-to-GDP comes down and it is well documented.

You can see that an increase in the consumer price index (CPI) also reduces the public debt (as a percentage of GDP).

So unlike people think, the central bank doesn’t have much control over inflation just by adjusting the interest rates. They also need to make sure that the debt-to-GDP is under control.

The first chart I published above shows the debt-to-GDP ratio. But look at the chart below. The public debt is constantly increasing. Alarmingly. Because the government always has expenditures and obligations.

I am only taking the US into consideration because they are the mother of all capital markets. While the debt and debt-to-GDP ratio is still under control in developing nations, USD is still the world reserve currency and oil is priced in USD.

What happens in other countries doesn’t really matter because when the USD inflates, they export the inflation to all the other countries.

After all, almost all the countries have USD in their FX reserves which impacts the purchasing power of the country. Despite the USD inflating, many countries’ currencies are not getting stronger against the dollar, but weaker.

Recently Japan’s currency devalued quite fast against the USD. Check Turkey and Argentina, it’s worse. Like very very bad.

The US public debt is projected to become 200% of GDP by 2053.

The above chart is a rough extrapolation based on current trends.

What to Expect in the Next 2-3 Decades?

Based on my understanding, I expect the following things to happen in the next 20-30 years and I am going to be prepared for it.

Inflation cannot be controlled because the only tool to fix inflation is increasing interest rates and discouraging consumer and corporate debt. But when the government itself needs more debt and has massive interest payments on debt, increasing interest rates too much can lead to insolvency.

Prices of everything will go up because more debt will cause a higher M2 money supply. People who have assets (stocks, gold, real estate, and bitcoin) can protect themselves against inflation to some extent.

People who don’t have investments (90%) will see that the price of everything is going up, their income is not going up and they won’t be able to save or invest.

Rich will get richer (because of asset price inflation) and the poor will get poorer (because they don’t have assets or savings and the cost of living goes up). This will increase the wealth gap. When it becomes too much, there will be anger at the government from the majority.

Governments won’t be frugal with their spending because they have promised too much. Governments will appeal to the 90% and not the 10% who have assets. The political narrative will shift towards “tax the rich” they are the problem. Capital gains tax might go up unrealistically along with all the other taxes. A new political leader who promises to tax the rich and redistribute the wealth might get voted into power.

Asset prices will skyrocket in the long term. Gold and Bitcoin might go up faster than real estate because property taxes on real estate might go too high making it a bad form of savings and investment.

Cheap capital will flood the market leading to an infinite bubble in startups (both private and public).

I will leave you with a final thought. The Total US debt stands at 34.7 Trillion. And if you look at unfunded liabilities (future obligations such as pensions and social security without interest) it’s more than $200 Trillion with a T. This is unsustainable. It’s an unimaginable number.

This brings into question whether the current financial system is stable. Is it fair? Does it serve everyone equally?

Sophisticated people who have access to debt take on debt and buy hard assets with it (like homes). People who live hand-to-mouth month-on-month might get poorer and won’t be able to afford anything. The problem is created because of an ever inflating currency supply.

Post covid, the richest have become richer by 40%, and the poor have become poorer by 40%. If this continues it might lead to a total social collapse. The crime rate can go up when people are jobless and need something to survive on. Morality breaks down.

Unprecedented times ahead. Brace yourself.

P.S. This post is not financial advice. This is just my thoughts. Please excuse any factual errors. I am not a professional economist. Just an everyday citizen and startup founder trying to get a grasp on what’s going on in the world.

Very serious stuff. Everyone may not understand it fully. However, you have done well Deepak sir. Interesting read ... this was.